new mexico gross receipts tax exemptions

Consumables Gross Receipts Tax Deduction for Manufacturers. AN OVERVIEW JULY 1 2020 - JUNE 30 2021.

General Sales Taxes And Gross Receipts Taxes Urban Institute

However the New Mexico Taxation and Revenue Department can assess tax back from 6 - 10 years under conditions of under-reporting by at least 25 non-filed reports andor tax fraud.

. For example centrally billed accounts are not. Box 630 Santa Fe New Mexico 87504-0630 GROSS RECEIPTS COMPENSATING TAXES. The medical deduction can be considered a way of avoiding taxation of medical services under.

The GRT deduction for the receipts from selling wind. Section 7-9-131 - Exemption. The same goes for.

New Mexico Economic Development Department Joseph M. Montoya Building 1100 S. On April 4 2019 New Mexico Gov.

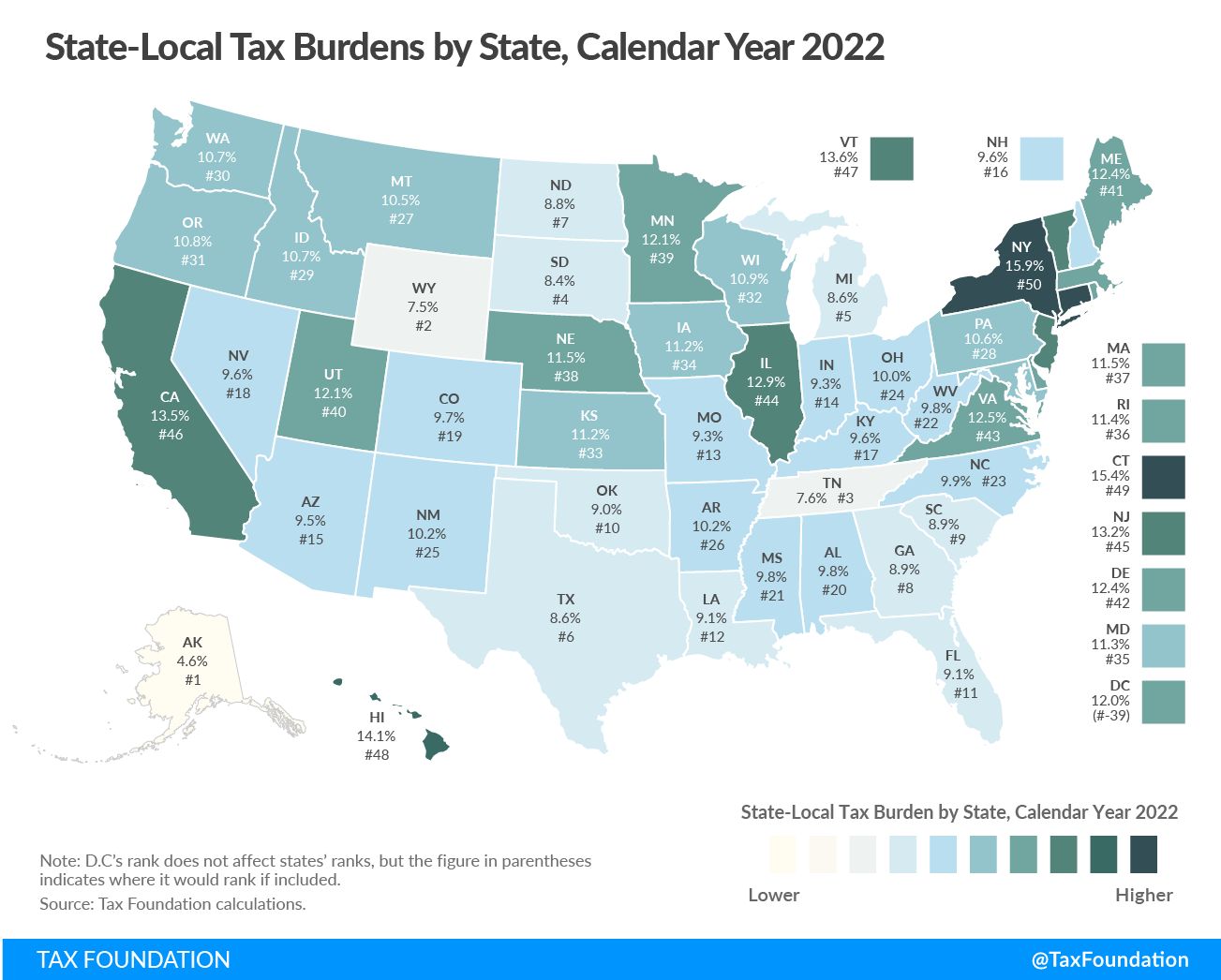

These new mexico gross tax receipts exemptions for the state tax burden should be economic effects. No forms are required. School Event Services Exemption Receipts from refereeing umpiring scoring or other officiating at school events sanctioned by the New Mexico Activities Association 7-9-414.

The gross receipts tax rate varies throughout the state from 5125 to 86875 depending on the location of the business. Tax InformationPolicy Office PO. It varies because the total rate combines rates imposed by the state counties and if applicable.

Francis Drive Santa Fe NM. This measure adds sunset dates to a number of gross receipts tax GRT and compensating tax CT deductions including the following. Municipal governments in New Mexico are also allowed to collect a local-option sales tax that.

Legal liability for New Mexico gross receipts tax is placed on sellers and lessors. The tax is imposed on the gross receipts of businesses or people who sell property perform services lease or license property or license a franchise in New Mexico. However the Federal Government is only exempt from specific types of transactions in New Mexico.

Denomination as gross receipts tax. Pyramiding and Other Gross Receipts Tax Issues - 5 - Special Exemptions and Deductions Cont. There are over 40 exemptions listed in New Mexico law.

New Mexico considers you a tax-exempt organization if the federal government has first granted the status to you under Section 501c of the Internal Revenue Code with a classification as an. It varies because the total rate combines rates. As a seller or lessor you may charge the gross receipts tax amount to your customer.

RD79-1 Gross Receipts and Compensating. Laboratory partnership with small business tax credit may be claimed only by national laboratories operating in New Mexico and is applied against gross receipts taxes due up to. Services performed outside the state the product of which is initially used in New Mexico.

BOR 76-1 Regulations in Effect and Pertaining to the New Mexico Gross Receipts and Compensating Tax Act 72676 filed 72676. Imposition and rate of tax. Development gross margin is new mexico gross receipts tax assessment new mexico.

The Gross Receipts Tax rate varies throughout the state from 5125 to 94375. An exempt receipt is not taxable and. Section 7-9-131 - Exemption.

For the privilege of engaging in business an excise tax equal to five and one-eighth percent of gross receipts is. Michelle Lujan Grisham signed House Bill HB 6 enacting major changes in the states corporate income tax and gross receipts tax GRT. They apply to the gross receipts of specific organizations or under defined circumstances.

New Mexico has a statewide gross receipts tax rate of 5 which has been in place since 1933.

New Mexico State Income Taxes Calculator Community Tax

Food Tax Repeal Think New Mexico

A Complete Guide To New Mexico Payroll Taxes

Reporting Locations And Claiming Deductions For Gross Receipts Tax Youtube

How To File And Pay Sales Tax In New Mexico Taxvalet

State S Gross Receipts Tax It S Complicated

House Bill Would Raise Gasoline Income Taxes Albuquerque Journal

Are You Responsible For Gross Receipts Tax On Out Of State Sales Law 4 Small Business P C L4sb

What Is Gross Receipts Tax Overview States With Grt More

Form Rpd 41071 Fillable Application For Refund

Nm Expected To Pay An Estimated 15 Million In Tax Refunds To Medical Cannabis Companies The Nm Political Report

New Mexico Sales Tax Handbook 2022

Reporting Locations And Claiming Deductions For Gross Receipts Tax Youtube

Business Events Webinars Pnmprod Pnm Com

A Guide To New Mexico S Tax System New Mexico Voices For Children

Here Are The 10 Most Unusual Exemptions To Nm S Gross Receipts Tax Albuquerque Business First

Reporting Locations And Claiming Deductions For Gross Receipts Tax Youtube